What is Forex (FX) and How does Forex Trading Work?

Trading forex involves buying one

currency and selling another

simultaneously. Through careful

analysis, traders predict the potential

direction of currency prices and

attempt to capture gains based on

price fluctuations. There is no

centralised exchange for forex

trading. Rather, it takes place

electronically or online, between

networks of global computers. The

market is open 24 hours a day, 5

days a week.

How Do Forex Markets Work?

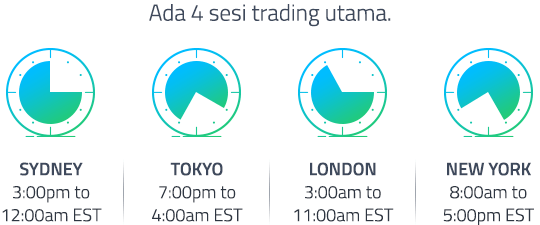

Forex is the most popular over-the-counter (OTC) market. In forex, currencies are bought and sold through a network of banks. As there

is no exchange, forex trading is decentralised and trading can take place 24 hours per day. There are 4 main trading sessions, namely

Sydney, London, New York and Tokyo.

The most popular forex market type is the spot forex market. In forex, spot trades involve the exchange of currency pairs electronically

using an online trading platform. Other market types include the forward forex market and futures forex market.

Keep in mind that timings in some countries, like Australia,

the US and UK, shift to/from daylight savings time in

October/November and March/April. So, plan your trades

accordingly. Market liquidity for currency pairs depends on

the forex trading sessions. For instance, the EUR/USD pair

shows a lot of movement and liquidity during the confluence

of the London and New York sessions. The AUD/USD pair

shows maximum movement in the Tokyo and London

sessions. Once you know when to trade, the next step is to

learn the jargon. So, here are some terms and concepts you

will come across in the market.